‘We, village chiefs and local councillors, welcome the information and sensibilisation campaign, because it helps us better understand the details of the new Land Law and to see what it takes to formulate the request for the establishment of a Rural Land Plan for our village’

Village Chief in the Municipality of Klouékanmè, Benin.

VNG International Annual Update 2017

4 Mobilising Local Resources

Is has been known for a long time that clearly established property rights are conducive for investments and maintenance and, therewith, for local development. In addition, property is a good basis for levying local taxes, which allow local governments to invest in basic services and infrastructure. More and more, mobilisation of domestic resources will become an important basis for development, next to outside support. In line with this tendency, helping to set up or improve systems for property registration and systems for fair and effective local taxation will become an ever more important part of our projects portfolio in the coming years. We are ready for it, with the effective approach that we have developed in this field.

In five large and smaller cities in Ghana, we applied our approach in the project ‘Improving Local Taxation and Services to the Public’ (2015-2016) financed by the Netherlands Embassy. The tax gap in Ghana is extremely big: up to 95 %. There are no reliant databases, the collection system is corrupt and hard to control due to the completely cash-based approach and the lack of IT support. This leads to high inefficiencies and lack of trust.

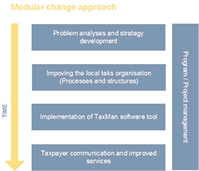

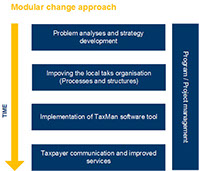

Our modular methodology empowers municipalities to take command again and to improve both their tax collection and service delivery, thereby strengthening civil engagement and government accountability. Since our approach starts with a problem analysis and strategy development, political commitment and leadership are a precondition for success. In Ghana, we involved all stakeholders, which significantly reduced the reluctance to pay. Another success factor was the introduction of –very simple– technology to support the agreed procedures, which also reduced the possibilities for fraud. The capacity-building of staff also proved very valuable, with a combination of making responsibilities explicit, providing training and advice, and creating teams who work together for a longer period of time. On the basis of the project results, the Netherlands Embassy in Accra, provided budget for the period 2017 -2020 to continue local tax support to Ghanaian municipalities.

.............................

The following results have been obtained:

• in Kadjebi revenues have doubled in only a year;

• in Elmina the tax collection base has been increased with a factor 20, because of an improved database and the addition of extra buildings to the database;

• Kumasi has significantly increased the revenues (up to 100 % in some months) by signing a social contract with the so-called ‘market queens’. These help with the tax collection, in exchange for better sanitation, better cleaning after market hours and more electricity connections;

• in the big harbour city Tema a strategy has been developed for the phased transition from the existing outsourcing of the tax collection (against 30 % of the tax revenues) to an in-sourcement model;

• Sekondi Takoradi has documented its implementation processes for tax mobilisation and collection and the corresponding IT services. These manuals, which did not exist in Ghana, will be offered country-wide via the national local government association to its members.

Financed by the Netherlands Embassy in Cotonou, VNG International, together with LID Management is implementing the ‘Local Land Management Support Project’ in Benin (2015-2018). The project supports the implementation of the Land Law which was adopted in 2013. Instruments were developed, and tested in two municipalities. Via the national local government association, ANCB, the experiences will be shared with other municipalities in Benin and used as input for further policy development at the national level. Key characteristic of the approach is that communities define the property rights as much as possible amongst themselves on the basis of consensus. Then the rights are registered. As a result the number of cases for which a more complicated, time-consuming and expensive legal process is needed, remains limited. This approach is used first in several carefully selected villages only. The need to start at a modest level, is understood, but at the same time the results are so appealing that there is much pressure to scale up. VNG International actively participates in a national platform for the coordination with other projects in this area, led by ANDF, part of the ministry of Finance.

The project ‘Support the design of the national property valuation standards in the Palestinian Territories’ (2015-2016) was implemented by VNG International within the Framework Contract ‘Capacity Building in Taxation in Dutch Partner Countries’ between the State of the Netherlands and the International Bureau of Fiscal Documentation (IBFD).

Based on our analysis, and taking into account the needs, the current situation and existing approaches, we proposed an approach for the introduction of property valuation and taxation and identified a set of follow-up steps. These include the creation and the basic ‘modus operandi’ of a ‘Standards Committee’, the creation of a the multi-purpose property inventory, and statistical support to Palestinian stakeholders to identify gaps in the data collection and to combine data sets in order to obtain meaningful information. Besides these three content-driven follow-up steps, we also advised on how to drive and supervise the reform initiatives.

Policy development and exchange of experience

VNG International presented its methodology to improve local taxation in a workshop for the annual meeting, in May 2016, of the DeLoG network, of which we are an active member. DeLoG is an informal network of of 29 bi- and multilateral development partners in the field of decentralisation and local governance. It was established in 2006 and functions as a knowledge hub and a network for knowledge exchange as well as a platform for joint learning.

Following the Addis Tax Agreement, VNG International took the initiative to bring together the Dutch expertise on taxation and to develop an innovative concept to assist local governments with, on the one hand, increasing their tax revenues, and on the other hand creating a social contract with citizens and companies on how to prioritise the use of the tax revenues for local. The methodology consists of the following components:

- problem analysis together with the various stakeholders, and drafting of an improvement contract (social contract);

- improvement of processes and tax collection procedures of the local government, focused on citizens reality rather than the internal organisation;

- provision of software to apply the improved procedures in a more efficient and effective manner;

- support for the development of communication plans and campaigns, and training of civil servants in social and communication skills;

- help in sustaining the change, in a well-developed project organisation and with professionalised staff.